The H20 Backfire!! Why Nvidia Is Destroying $4.5 Billion in China-Bound AI Chips??

Nvidia takes a $4.5B hit, scrapping H20 AI chips made for China after new U.S. export bans. Here’s why the workaround failed—and what comes next.

Introduction

Nvidia, the dominant force in AI semiconductors, shocked the market despite posting blockbuster earnings by revealing a painful truth: it’s writing off $4.5 billion worth of unsellable H20 AI chips.

These chips—specifically the H20 model—were custom-built for the Chinese market under previous U.S. export regulations. But new rules under the Trump administration slammed the door shut, leaving Nvidia with a mountain of advanced silicon it can’t legally deliver, repurpose, or easily resell.

This decision isn’t just a business hiccup—it reflects the growing cost of the U.S.-China tech war and how geopolitical shifts can burn even the most successful tech giants.

5 Critical Insights into Nvidia’s $4.5 Billion Write-Off

H20 chips were designed specifically for China’s AI market under earlier, less restrictive export rules.

The Trump administration’s April 2025 export ban suddenly made these chips illegal to ship to China.

Technical constraints prevent Nvidia from easily repurposing or reselling H20 chips outside China.

Selling H20 chips at a discount risks damaging Nvidia’s premium brand and undermining its newer AI product launches.

The write-off highlights supply chain risks for Nvidia and its manufacturing partners like TSMC and Samsung.

A Custom-Built Mistake

The H20 chips were a strategic compromise. In response to Biden’s earlier export controls aimed at curbing China’s AI ambitions, Nvidia engineered these second-tier chips to fly under the radar.

They were less powerful than the cutting-edge H100 and Blackwell GPUs, but still capable enough for Chinese tech giants like Alibaba and Tencent to train large language models and build competitive AI.

However, that strategy unravelled fast when the Trump administration returned to office and enforced a stricter policy in April 2025—banning all AI chip exports to China, including lower-tier versions like the H20.

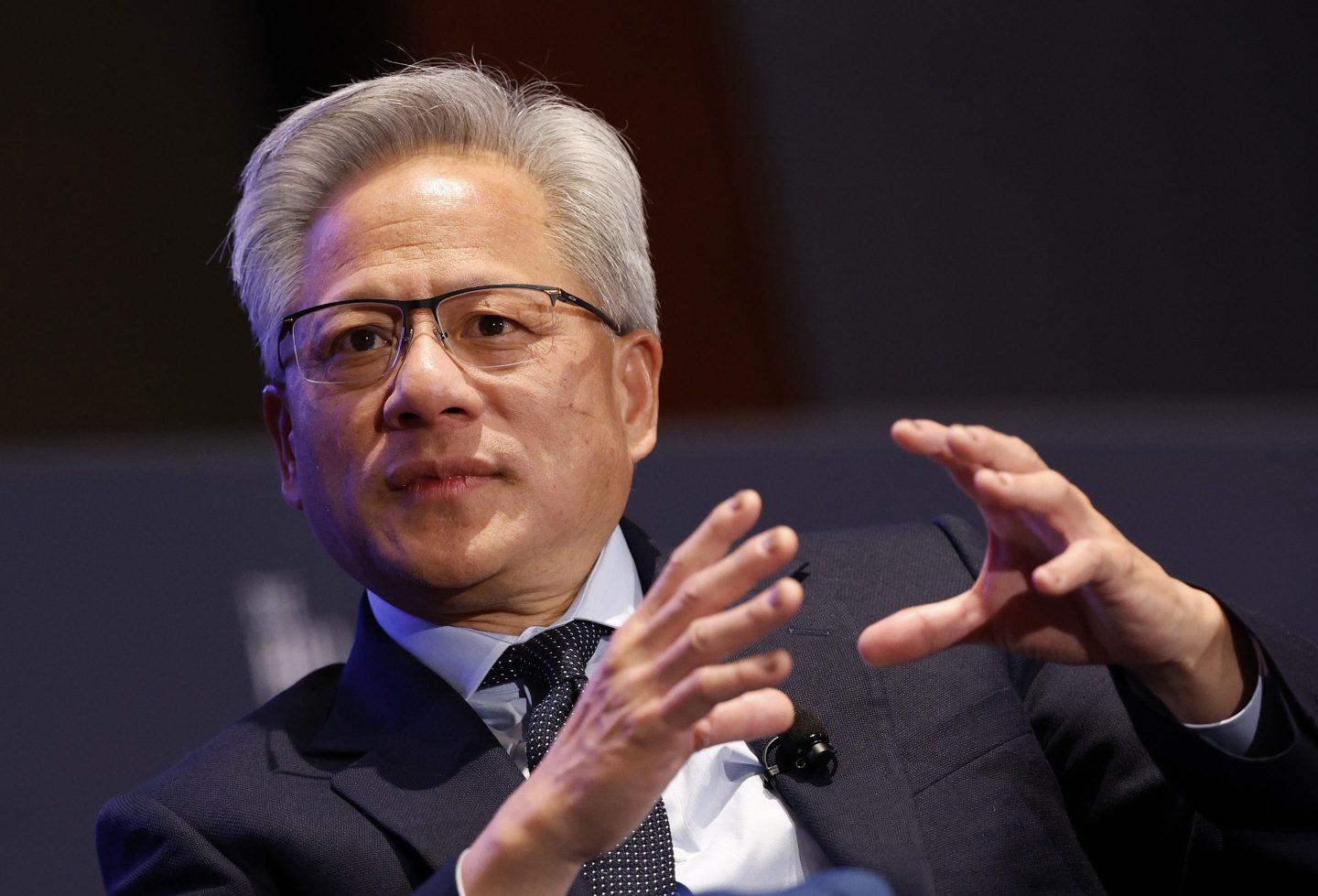

“We are taking a multibillion-dollar write-off on inventory that cannot be sold or repurposed,” said CEO Jensen Huang during Nvidia’s Q1 2025 earnings call.

techovedas.com/blackwell-goes-east-nvidia-builds-china-specific-ai-chips-post-h20-ban

Why Not Just Sell Them Elsewhere?

Here’s the catch: the H20 chips were custom-built for China’s regulatory environment and specific AI needs. According to supply chain experts, using them in other markets would require expensive modifications, and even then, they’d likely fall short of performance expectations.

“It doesn’t really fit anywhere else without a lot of expensive tweaking,” explains Arash Azadegan, supply chain professor at Rutgers.

On top of that, selling these chips at a deep discount to other customers could undermine Nvidia’s brand as a premium chipmaker. It might confuse customers and clash with the rollout of Nvidia’s new Blackwell GPUs, now powering systems at Amazon, Microsoft, Google, and Oracle.

techovedas.com/major-leadership-shake-ups-in-chinas-semiconductor-industry/#google_vignette

A Strategic Write-Off with Tax Benefits

Instead of offloading these chips on the cheap or repurposing them, Nvidia took the drastic but calculated route: write down the full $5.5 billion inventory, later salvaging $1 billion in reusable parts, bringing the net write-off to $4.5 billion.

This move isn’t just about cutting losses—it provides an immediate tax benefit by reducing taxable income in a year when Nvidia’s profits are soaring. In Q1 2025, the company reported $44.1 billion in revenue (up 69% YoY) and $18.8 billion in net income with a 42.6% profit margin.

Fallout for Nvidia’s Partners

The ripple effect won’t end with Nvidia. Suppliers and manufacturers like TSMC, Samsung, and Micron, who helped build and deliver the H20 chips, may face long-term challenges. These companies ramped up production for Nvidia’s China-bound AI components and are now left with excess capacity and uncertain demand.

“It’s never on a dime that we can pivot,” said Azadegan, signaling that the real strain may show up downstream.

Could the H20 Still Find a Home?

Analyst Harsh Kumar from Piper Sandler suggested there’s still a chance the Trump administration could relax or reverse the export ban—especially if Nvidia continues lobbying. If that happens, and if Nvidia keeps the chips in storage, they could still find their way into Chinese data centers.

But for now, the H20 serves as a billion-dollar lesson in how even the most sophisticated tech strategy can collapse under political pressure.

Conclusion

Nvidia $4.5 billion H20 AI chips write-off is a sobering reminder of how fast-moving geopolitical winds can upend even the most carefully calculated tech strategies. Though the loss appears manageable for Nvidia, it exposes vulnerabilities in global tech supply chains and the risks of designing products for politically volatile markets. For now, the H20 chips are a costly casualty in the ongoing tech cold war.

News

DOLLY PARTON’S $20 MILLION PROMISE: THE COUNTRY LEGEND WHO TURNED GRIEF INTO GRACE — AND REKINDLED AMERICA’S FAITH IN LEGACY

THE CALL THAT CHANGED EVERYTHING The morning it broke, America didn’t quite know what to do with itself.No scandal. No…

THE FOOTAGE THEY TRIED TO ERASE: THE FINAL MINUTES OF CHARLIE KIRK — AND THE DOCTOR WHO BROKE HIS SILENCE

THE VIDEO THAT SHOULDN’T EXIST It began at 3:14 a.m. — with an upload to a private Telegram channel called…

The Betrayal of a Patriot: A Cinematic Conspiracy Unraveled

The stage was set in the heart of Phoenix, Arizona, under a blazing desert sun. The air crackled with anticipation…

The 𝐇𝐞𝐫𝐦𝐚𝐩𝐡𝐫𝐨𝐝𝐢 Slave Who Was Shared Between Master and His Wife… Both Became Obsessed (1851)

In the sweltering August of 1851, the tobacco fields of Southside Virginia held secrets far darker than the thick red…

Rich Young Master Spends Money To Force Black Maid To Crawl Like A Dog Just For Fun – Her Reaction Shocks Everyone…

Morning in Bell Ridge always arrived polished—dew on clipped lawns, a flag snapping above City Hall, white magnolias leaning over…

She Was Fired for Helping a Veteran’s Dog! Minutes Later, Marines Stormed the Café

The morning light over Mason, Georgia, looked cooler than it felt—silver on storefront glass, a flag lifting over the courthouse,…

End of content

No more pages to load