Part 1

The family meeting was scheduled for 2:00 p.m. on Sunday at what Dad called “the estate,” a sprawling Colonial-style mansion in the United States where he and Mom lived. Everyone was required to attend—me, my brother Tyler, my sister Jessica, plus their spouses and kids. Dad had sent a formal email with the subject line: Important Family Business Discussion.

I arrived early, parking my Tesla in the circular driveway. Through the front windows, I could see Dad pacing in his study, papers spread across his mahogany desk. Mom was arranging chairs in the living room like this was a board meeting.

Tyler’s Range Rover pulled up, followed by Jessica’s Mercedes SUV. Both vehicles gleamed. Both screamed success they hadn’t actually achieved.

“Sophie.” Mom greeted me at the door with a tight hug. “I’m so glad you could make it. I know you’re always so busy with your computer work.”

Computer work. My software engineering consulting firm generated $800,000 annually, but to them I was still just doing “something with computers.”

We gathered in the living room. Tyler sprawled in the leather armchair like he owned it. Jessica perched on the sofa, her husband Brad beside her, looking uncomfortable. Their kids had been sent to the playroom upstairs. Dad stood by the fireplace, hands clasped behind his back. He loved this pose—the patriarch delivering important news.

“Thank you all for coming,” he began. “Your mother and I have been doing some estate planning, and we need to discuss family assets.”

I sipped my water and waited.

“As you know, our family has been fortunate with several properties over the years,” Dad said. “This house, Tyler’s place on Riverside, Jessica’s townhouse downtown, Sophie’s little condo, the lake cabin, and a few rental properties.”

Little condo—my 2,400‑square‑foot penthouse in the most expensive building in the city. But sure, little.

“Your mother and I are getting older,” Dad continued. “We need to start thinking about succession—about making sure these properties serve the family’s needs.”

Tyler leaned forward, interested now. Jessica’s eyes gleamed.

“We’ve decided,” Dad said, pulling out a folder, “to redistribute the family properties to better match everyone’s current situations.”

Here it comes, I thought.

“Tyler, you and Amanda have four children. Your current house is too small. You’ll be moving into this estate. It has six bedrooms—plenty of space for your growing family.”

Tyler’s face lit up. “That… that’s—well, thank you.”

“Jessica,” Dad continued, “you and Brad need more space for your business ventures. You’ll be taking Sophie’s penthouse downtown. It’s much better suited for the entertaining you do.”

My penthouse. The property I purchased four years ago for $1.2 million.

Jessica actually clapped her hands. “Oh my gosh, Dad, that place is gorgeous. Sophie, you won’t mind, right? You’re never there anyway with all your traveling.”

All eyes turned to me. I set down my water glass carefully. “Where will I be living?” I asked, calm as ice.

“We thought about that,” Mom jumped in. “You can have the apartment above the garage here. It’s cozy, and you’re always saying you want something low‑maintenance.”

The garage apartment. Six hundred square feet. No view. Originally designed for a live‑in housekeeper.

“And what about my current place?” I asked.

“Jessica needs it more,” Dad said firmly. “She’s building a business, networking with important people. You’re just working remotely. You can do that from anywhere.”

Tyler was already on his phone, probably texting Amanda about the mansion. Jessica was making notes, likely planning her redecorating.

“What about the rental properties?” I asked.

“Those will be divided between Tyler and Jessica to manage,” Dad said. “They need the passive income for their families. You’re doing fine on your own.”

I nodded slowly. “And you’ve already made these decisions. This isn’t a discussion—it’s an announcement.”

“We’re your parents,” Dad said. “We know what’s best for the family as a whole. Sometimes that means individual sacrifice for the greater good.”

“Individual sacrifice,” I repeated. “Interesting way to phrase taking my home.”

“It’s not your home, Sophie,” Mom said gently. “It’s family property. Your grandmother’s trust provided the down payment years ago. That makes it family property.”

I pulled out my phone and opened a specific folder I’d prepared for exactly this moment. “Dad, do you remember what happened eight years ago? The market crash.”

His face tightened. “That’s ancient history.”

“Your real estate investments collapsed,” I said. “You were over‑leveraged, drowning in debt, facing foreclosure on everything—this mansion, Tyler’s house, Jessica’s townhouse, the lake cabin, all the rental properties. The bank was taking all of it.”

“We went through a rough patch,” Dad said stiffly. “We recovered.”

“No. You didn’t recover. I recovered you.”

I stood, phone in hand. “I was twenty‑six. I had just sold my first startup for $4.5 million. You came to me desperate, asking for help. Do you remember what you said?”

Silence.

“You said, ‘Sophie, you’re good with money. Help us figure this out.’ So I did. I bought everything. All of it. Every single property you were about to lose.”

Tyler sat up straight. “What are you talking about?”

“Eight years ago, I purchased this mansion, Tyler’s house, Jessica’s townhouse, the lake cabin, and all six rental properties. I paid off Dad’s debts, cleared the mortgages, and saved the family from complete financial ruin.”

Jessica’s face went pale. “That’s not possible. We own our houses.”

“No, you don’t. You live in my houses—rent‑free. All of you. For eight years.”

I pulled up documents on my phone. “Every property is owned by Clear View Holdings, LLC. That’s my company. My name is on every deed.”

Dad’s face turned red. “You said you’d help us. You didn’t say you were buying everything.”

“You assumed I’d loan you money. I said I’d handle it. I handled it by becoming your landlord.”

“This is ridiculous,” Tyler said, standing. “Even if that’s technically true, these are family properties. You can’t just claim them.”

“I’m not claiming anything. I already own them. I have for eight years. I’ve paid every property‑tax bill, every insurance premium, every repair and maintenance cost—out of my pocket—while you all lived rent‑free and told people you owned these places.”

Mom’s voice shook. “Why would you keep this from us?”

“I didn’t deceive anyone. I saved you from bankruptcy, and I didn’t announce it because of exactly this—the moment you knew I had money, it would become ‘family money.’ My success would become something you believed you were entitled to.”

“We’re your family,” Jessica said. “You’re supposed to share with us.”

“I have been sharing for eight years—free housing for everyone. But that isn’t enough. You want to take my penthouse, give me a garage apartment, and call it a favor.”

Dad tried to regain control. “Sophie, let’s not be hasty. Even if what you’re saying is true, we can work this out as a family.”

“We’re past that.”

I opened another folder on my phone. “I knew this was coming. Mom mentioned ‘estate planning’ to Tyler three months ago. Tyler told Jessica. Jessica told her realtor friend she’d be moving soon. Word gets around.”

Tyler’s face said I was right.

“So I prepared,” I said, turning the screen. “These are eviction notices for all family members currently occupying my properties without valid lease agreements—that’s this mansion, Tyler’s house, Jessica’s townhouse, the lake cabin, and three rental properties where extended family members live.”

“You can’t evict your own family,” Mom gasped.

“Watch me. You’ll receive formal notices this week. Thirty days to vacate.”

“Where are we supposed to go?” Tyler demanded.

“That’s not my problem. You’re adults. Figure it out.”

Jessica started crying. “We have kids. You’d make your nieces and nephews homeless.”

“You made them vulnerable by assuming you could take my property. I’m enforcing boundaries.”

The room erupted—Tyler shouting about betrayal, Jessica sobbing, Mom begging, Dad threatening legal action. Brad sat frozen, realizing his entire lifestyle was wobbling.

I headed for the door.

“Sophie,” Dad said, voice booming. “If you walk out that door, you’re not part of this family anymore.”

I turned back. “Dad, you just tried to give away my home and relegate me to a garage apartment. I haven’t been part of this family in the way you imagine for a long time.”

Part 2

The eviction notices were served on Tuesday. My attorney, Marcus Chin, handled everything properly, delivering each notice with a police officer present as a witness, in compliance with local U.S. housing laws.

The calls started immediately—angry calls from Tyler, tearful voicemails from Mom. Even my uncle Frank called. He’d been living rent‑free in one of my rental properties for four years and had just been served.

I blocked most of them and forwarded the rest to Marcus.

“Your family is threatening to sue,” Marcus told me over lunch. “They’re alleging elder abuse, fraud, and something called ‘family property rights’ that doesn’t exist in law.”

“Let them sue,” I said. “I have every document, every deed, every payment record. It’s all clean.”

“They’re also telling people you’re taking from them,” Marcus added. “Your sister posted on social media that you’re evicting your parents.”

I pulled out my phone and looked at Jessica’s post. There I was, painted as the villain—cold‑hearted daughter throwing her family onto the street. The comments were harsh. Cousins I hadn’t spoken to in years called me greedy. Family friends expressed shock.

“Let them talk,” I said. “The truth has a way of surfacing.”

And it did—three days later—when Tyler tried to refinance his house and discovered he wasn’t on the deed.

The bank officer, confused, pulled the property records. Tyler’s mortgage broker called him with the news: “Sir, you don’t own this property. Clear View Holdings, LLC does. Have you been renting?”

Tyler’s furious call to me was almost surreal. “The bank says I don’t own my house. They’re saying some company owns it. What did you do?”

“I told you at the family meeting. I own that house. I’ve owned it for eight years.”

“This is identity theft—fraud. I’m calling the police.”

“Go ahead. Explain that you’ve been living rent‑free in someone else’s property for eight years while telling people you own it. I’m sure they’ll find that interesting.”

He hung up.

The real blowup came when Dad tried to get a home‑equity line of credit on his mansion. The bank pulled the deed and found the same thing: Clear View Holdings, LLC — Owner: Sophie Morrison.

Dad showed up at my downtown office. Security called to warn me. “Let him come,” I said.

He burst in, red‑faced. “You forged documents. You took our house.”

“I have every bank statement, every closing document, every payment record from eight years ago. Your signature is on the documents transferring the properties to my company. Want to see them?”

I turned my monitor. Folder after folder of legal documents, all properly executed, all with his signature.

His face went from red to chalk. “You actually bought everything.”

“Yes.”

“We had no idea.”

“You never asked. You assumed—just like you assumed you could give away my penthouse and move me above the garage.”

He sank into a chair. “What do you want, Sophie?”

“Accountability.”

“We don’t have money.”

“I know. You’ve been living beyond your means for years—counting on houses you didn’t own, taking out credit cards and personal loans against future income that never arrived.”

I pulled up another document. “Tyler owes $85,000 in credit‑card debt. Jessica’s business has lost money for three straight years. You and Mom have $170,000 in personal loans. I know because I keep records.”

“How?”

“Because I’m the one who bailed you out eight years ago. Did you think I wouldn’t track what I saved?”

“So what now? You throw us out and watch us struggle?”

“No. I enforce boundaries you should have respected.”

I slid papers across my desk. “Here’s what happens: You have thirty days to vacate the mansion. Tyler has thirty days to vacate his house. Jessica has thirty days to vacate her townhouse. Everyone in my rental properties has thirty days. Or… you can sign these.”

He looked down.

“Lease agreements,” I said. “Market rate for each property. If you can afford it, you can stay as legitimate tenants. First month, last month, security deposit—standard terms. Miss one payment and eviction proceeds.”

Dad stared at the numbers. “The mansion is $8,500 a month. We can’t afford that.”

“Then downsize. Find something you can afford. That’s how it works.”

“This is harsh.”

“What’s harsh is spending eight years living rent‑free in my properties, then trying to take more without asking. What’s harsh is calling my work ‘computer stuff’ while I was building a U.S. company with international clients. What’s harsh is treating me like I was less important than Tyler and Jessica, then expecting me to subsidize everyone forever.”

He sat in silence, the lease in his hands.

“I built an empire, Dad—twelve properties, three million in equity, a consulting business spanning five countries. I did it while quietly supporting the entire family. And you thanked me by trying to hand my home to someone else.”

“We didn’t know.”

“You didn’t care to know. There’s a difference.”

Part 3

The thirty days passed. Mom and Dad signed a lease for a three‑bedroom house I owned in another neighborhood—$1,280 a month on a long‑term arrangement that fit their budget and complied with local regulations. Tyler and Amanda downsized to a rental they could actually afford—not one of mine. Jessica moved in with Brad’s parents, her ego bruised but intact. Uncle Frank found a studio apartment. The rest of the extended family scattered to places within their actual budgets.

My properties were re‑rented within weeks to professional tenants—background‑checked, properly screened, people who paid on time and took care of what they rented.

Three months later, Tyler showed up at my office. No appointment. Security called; I told them to send him up.

He looked thinner, tired, but more grounded. “I’m not here to ask for anything,” he said right away. “I just wanted to say I get it now.”

I waited.

“Amanda and I are in a two‑bedroom apartment. The kids share rooms. We sold the Range Rover and bought a used Honda. We’re on a budget for the first time.” He let out a dry laugh. “It’s humbling, but it’s real. We’re done pretending.”

“That’s good, Tyler.”

“I didn’t know you owned everything. But I should’ve known something was off. The property taxes alone on that house had to be around $15,000 a year. I never paid them. Never even saw a bill. I didn’t ask questions because I didn’t want the answers.”

“Willful ignorance,” I said.

“Yeah.” He met my eyes. “I’m sorry—for assuming, for thinking you owed us, for going along with Dad’s plan to take your penthouse. You built something real, and we treated it like it was ours to distribute.”

It was the most honest conversation we’d ever had.

“Thank you for saying that,” I told him.

“Are you happy?” he asked. “Now that we’re out?”

I considered. “I’m not happy you’re struggling. But I’m at peace. I enforced boundaries I should’ve set years ago. I’m done being the family bank.”

He nodded. “For what it’s worth, Amanda says you did the right thing. She’s the one who told me to come here.”

“Tell her thank you.”

That evening, I looked out my office window at the city skyline—U.S. flags flickering on a nearby courthouse, commuters flowing down Seventh Avenue, sirens somewhere far away. Somewhere out there were my twelve properties, all properly managed, all generating income, all legally protected.

Dad called. “Your mother wants to invite you to dinner at our rental house.”

“I don’t think that’s a good idea yet,” I said.

“She’s not asking for anything. She just misses you.”

Something cracked in my chest. “I miss her, too. But Dad, I need you to understand something. I’m not going back to the way things were, where my success is dismissed and my property is treated like a family ATM.”

“I know,” he said softly. “I’m learning that.” He hesitated. “The lease payment is due next week. We’ll have it on time.”

“Good.”

“Sophie… you built something remarkable. I’m sorry I didn’t see it. I’m sorry I didn’t celebrate it. I’m sorry I tried to take it.”

My throat tightened. “Thanks, Dad. Maybe in a few months we can have that dinner—after we’ve proven we can respect each other’s boundaries.”

“Maybe,” he said. “Let’s see.”

Part 4

Six months later, I sat in my penthouse—my penthouse, still mine, never given away—and reviewed my portfolio. Fourteen properties now. I’d bought two more using rental income from the others, all documented and insured under U.S. law.

Mom and Dad paid their rent on time every month. Tyler and Amanda were rebuilding slowly, carefully. Jessica had taken a steady corporate job with benefits. The family was learning to stand on their own, and I was learning that boundaries aren’t cruel—they’re necessary.

My empire stood solid, built by me, owned by me, protected by me, and finally—finally—respected.

I locked my penthouse door and looked out at the skyline, portfolio app steady at sixteen properties and zero family tenants in arrears. A small U.S. flag on the courthouse across the avenue fluttered in the evening wind.

Dad texted a photo from their place—twelve rent receipts in a neat row and a note: “Thank you for the second chance. We’re learning.” I muted the chat, smiled, and set tomorrow’s walkthroughs. Boundaries weren’t a battle anymore. They were the blueprint.

-END-

News

He fired his maid six years ago. At the airport, he saw her shivering with two kids. Then the little boy smiled and said a name that destroyed him.

He Fired His Maid Six Years Ago. Today, He Saw Her at the Airport, Shivering, With Two Small Children. Then…

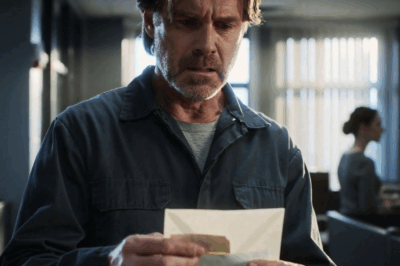

THE ENVELOPE SAID “24 HOURS.” WHAT I FOUND NEXT…

Part I My boss had never called me into his office without warning, and he had never looked afraid of…

“21 years of loyalty “— and they threw me out like trash. But they forgot one tiny detail in the paperwork…

Part I At 6:47 a.m. on a Tuesday that would change everything, I was flat on my back in a…

My Parents Sued to Evict Me So My Sister Could “Own Her First Home.” In Court, My 7-Year-Old Asked…

Part I My parents sued to evict me so my sister could own her first home. In court, my seven‑year‑old…

I Found a Receipt That Said “Come Back When You’re Ready.” So I Did.

Part I I was cleaning out my wallet when I found a receipt from a café I didn’t recognize. It…

Little Black Boy Gave Silent Signal To Police Dog – What It Found Next SHOCKED Everyone

Part I Sergeant Rex halted mid‑stride inside the central concourse like he had seen a ghost. His ears lifted, tracking…

End of content

No more pages to load